Once again the Obama Department of Justice has reached a settlement with a To Big To Fail Bank for pennies on the dollar and let the perpetrators walk away without criminal sanctions or penalties. Goldman Sachs will pay $5.06bn for its role in the 2008 financial crisis, the US Department of Justice said on Monday. …

Tag: mortgage fraud

Dec 25 2014

No Jail Time for Billionaire But There Is a Bit Of Justice

As David Dayen puts it, “it isn’t prison” but the consequences are at least a bit satisfying.

Finally, a Financial Executive Is Sacked for His Company’s Misdeeds

By David Dayen, The New Republic

Lets say you run a company whose misdeeds are splashed across the pages of the business section on an almost weekly basis. you might reasonably expect to be fired without delay. But then let’s stipulate that you’re in the financial service industry. Recent history suggest that you’ll be able to keep your job and your handsome bonus, and that even if law enforcement decide to penalize the company for improprieties, somebody else – like your shareholders – will pay those fines, leaving you to continue your charmed life unscathed.

William erbey, the billionaire chairman of the mortgage serving giant Ocwen, probably thought that would be his fate as well, but he didn’t anticipate the determination of New York Superintendent of Financial Services Benjamin Lawsky. On Monday, Lawsky announced that Erbey would step down from Ocwen and four related businesses, as part of the settlement of an investigation into the companies sad enduring legacy of ripping off homeowners.

The consequences for Erbey have been huge financial losses as Ocwen shares dropped 31% “after agreeing to a settlement that prevents it from acquiring mortgage-servicing rights until the company makes improvements to satisfy New York regulators.” The company must also provide $150 million for relief to homeowners and hire a monitor who will approve the appointment of two independent directors to Ocwen’s board and continue to oversee the business.

According to Forbes, poor Erbey is no longer a billionaire:

Erbey, according to Forbes’s Real Time Wealth Rankings for billionaires, lost over $300 million on Monday causing his net worth to fall to around $800 million and knocking him out of the billionaire ranks. He was worth as much as $2.5 billion in March when we published our annual listing of the world’s wealthiest. [..]

Forbes now calculates Erbey’s net worth at $802 million, as of late afternoon trading.

As Atrios said, “it’s sad that this is all we’ll get.”

Jun 18 2014

Too Big To Fail Banks Are Getting Bigger

Last week the city of Miami sued JP Morgan Chase for its predatory lending practices in Miami’e minority neighborhoods that caused a wave of foreclosures resulting in blight and high crime in those areas

There has been no criminal prosecution of these banking behemoths by the Department of Justice, not because of lack of evidence but because Attorney General Eric Holder refused to bring those charges. Instead Holder has negotiated with the banks and, in the case of JPMorgan, directly with the CEO’s, imposing large fines that most of these banks recoup in hours. We know that the Obama administration is top heavy with former Wall Street and banking executives from Obama’s Treasury Department, to the Department of Commerce down to his latest appointment Thomas Wheeler, as chair of the Federal Communications Commission. Why has this been allowed? Why haven’t the regulations and reforms been enacted? Why no prosecutions? One word answer: Congress. As PBS’s [Bill Moyer notes Congress is their secret weapon

These finance executives took part in “scandals that violate the most basic ethical norms,” as the head of the IMF Christine Lagarde put it last month, including illegal foreclosures, money laundering and the fixing of interest rate benchmarks. In fact, banking CEOs not only avoided prosecution but got average pay rises of 10 percent last year, taking home, on average, $13 million in compensation.

These “gentlemen” are among the leaders of the industry’s efforts to repeal, or water down, some of the tougher rules and regulations enacted in the Dodd-Frank legislation that was passed to prevent another crash. As usual, they’re swelling their ranks with the very people who helped to write that bill. More than two dozen federal officials have pushed through the revolving door to the private sector they once sought to regulate.

And then there are the lapdogs in Congress willfully collaborating with the financial industry. As the Center for Public Integrity put it recently, they are “Wall Street’s secret weapon,” a handful of representatives at the beck and call of the banks, eager to do their bidding. Jeb Hensarling is their head honcho. The Republican from Texas chairs the House Financial Services Committee, which functions for Wall Street like one of those no-tell motels with the neon sign. Hensarling makes no bones as to where his loyalties lie. “Occasionally we have been accused of trying to undermine aspects of Dodd-Frank,” he said recently, adding, with a chuckle, “I hope we’re guilty of it.” Guilty as charged, Congressman. And it tells us all we need to know about our bought and paid for government that you think it’s funny.

Mr. Moyers was joined by economist Anat Admati, co-author of the book, The Bankers’ New Clothes, to discuss the bipartisan effort to defang Dodd-Frank and let these Too Big To Fail banks get even bigger.

Wall Street banks are lobbying to defang sections of the law related to derivatives – the complex financial contracts at the core of the meltdown. One deregulation bill, the “London Whale Loophole Act,” would allow American banks to skip Dodd-Frank’s trading rules on derivatives if they are traded in countries that have similar regulatory structures.

Full transcript can be read here

Aug 13 2013

Mortgage Fraud Settlement: Is a Fraud

Cross posted from The Stars Hollow Gazette

As we have documented here at Stars Hollow, the task force that was created to pursue mortgage fraud and hold the banks accountable was, and is, a sham game to protect the banks from real relief for defrauded homeowners.

Your mortgage documents are fake!

by David Dayen, Salon

Prepare to be outraged. Newly obtained filings from this Florida woman’s lawsuit uncover a horrifying scheme

A newly unsealed lawsuit, which banks settled in 2012 for $1 billion, actually offers a different reason, providing a key answer to one of the persistent riddles of the financial crisis and its aftermath. The lawsuit states that banks resorted to fake documents because they could not legally establish true ownership of the loans when trying to foreclose.

This reality, which banks did not contest but instead settled out of court, means that tens of millions of mortgages in America still lack a legitimate chain of ownership, with implications far into the future. And if Congress, supported by the Obama Administration, goes back to the same housing finance system, with the same corrupt private entities who broke the nation’s private property system back in business packaging mortgages, then shame on all of us. [..]

Most of official Washington, including President Obama, wants to wind down mortgage giants Fannie Mae and Freddie Mac, and return to a system where private lenders create securitization trusts, packaging pools of loans and selling them to investors. Government would provide a limited guarantee to investors against catastrophic losses, but the private banks would make the securities, to generate more capital for home loans and expand homeownership.

That’s despite the evidence we now have that, the last time banks tried this, they ignored the law, failed to convey the mortgages and notes to the trusts, and ripped off investors trying to cover their tracks, to say nothing of how they violated the due process rights of homeowners and stole their homes with fake documents.

The very same banks that created this criminal enterprise and legal quagmire would be in control again. Why should we view this in any way as a sound public policy, instead of a ticking time bomb that could once again throw the private property system, a bulwark of capitalism and indeed civilization itself, into utter disarray? As Lynn Szymoniak puts it, “The President’s calling for private equity to return. Why would we return to this?”

White-collar fraud expert proves ‘mortgage-backed securities’ neither mortgage-backed nor secure

by Scott Kaufmann, The Raw Story

The forged documents were endorsed by employees of companies long bankrupt, executives who signed their name eight different ways, or “people” named “Bogus Assignee for Intervening Assignments” so that the banks could establish standing to foreclose in courts. The end result, according to white-collar fraud expert Lynn Szymoniak, is that over $1.4 trillion in mortgage-backed securities are still, to this day, based on fraudulent mortgage assignments.

The lawsuit against Wells Fargo, Bank of America, JPMorgan Chase, Citi and GMAC/Ally Bank was settled in early 2012 for $1 billion, but now that the evidence is unsealed, Szymoniak and her legal team are free to pursue the other named defendants, including HSBC, the Bank of New York Mellon, and US Bank. “I’m really glad I was part of collecting this money for the government, and I’m looking forward to going through discovery and collecting the rest of it,” Szymoniak told Salon.

Eric Holder Owes the American People an Apology

Jonathan Weil, Bloomberg News

The Justice Department made a long-overdue disclosure late Friday: Last year when U.S. Attorney General Eric Holder boasted about the successes that a high-profile task force racked up pursuing mortgage fraud, the numbers he trumpeted were grossly overstated. [..]

In an updated press release Friday, which corrected its initial release of last October, the Justice Department said a review of the cases found that the inflated figures included defendants who had been sentenced or convicted in fiscal year 2012 — not just people who had been criminally charged, as originally reported. Its original, lofty tally also included cases in which the victims weren’t distressed homeowners. [..]

What a charade. No wonder the government found it so difficult to bring a meaningful number of accounting-fraud cases against bank executives after the financial crisis. Its own books were cooked. [..]

This was the second time, mind you, that Holder’s Justice Department had pulled a stunt like this. In December 2010, Holder held a press conference to tout a supposed sweep by the president’s Financial Fraud Enforcement Task Force called “Operation Broken Trust.” (The mortgage-fraud program was part of the same task force.) As with the mortgage-fraud initiative, Broken Trust wasn’t actually a sweep. All the Justice Department did was lump together a bunch of small-fry, penny-ante fraud cases that had nothing to do with one another. Then it held a press gathering.

Between this sham that protects the banks and the egregious violations of the press and privacy of all Americans with abusive use of FISA, Eric Holder owes us more than an apology, he owes us his resignation as Attorney General.

May 09 2013

Mortgage Fraud Settlement: “Buyer’s Regret”

Cross posted from The Stars Hollow Gazette

New York State Attorney General Eric Schneiderman announced that he plans to sue Wells Fargo and Bank of America over claims that they breached the terms of a multibillion-dollar settlement intended to end foreclosure abuses.

Under the terms of the settlement, banks have to abide by 304 servicing standards, like notifying homeowners of missing documents within five days of receiving a loan modification and providing borrowers with a single point of contact.

“Wells Fargo and Bank of America have flagrantly violated those obligations, putting hundreds of homeowners across New York at greater risk of foreclosure,” Mr. Schneiderman said. Since October 2012, Mr. Schneiderman’s office has documented 210 separate violations involving Wells Fargo and 129 involving Bank of America.

Shahien Nasiripour reports at Huffington Post that it’s unclear if Mr. Schneiderman can do this:

The agreement does not specify whether he can independently pursue legal action against the banks without first allowing the Office of Mortgage Settlement Oversight, run by (Joseph) Smith, to determine whether they are complying, a process that could take months.

Smith’s office will make public by June 30 its first required report on the banks’ compliance with the mortgage servicing standards. The deal dictates that the companies shall have an opportunity to correct potential violations once they are identified. If the same violations continue, the monitoring committee could launch lawsuits and levy penalties totaling as much as $5 million for each violation.

But as attorney and writer Abigail Field notes at naked capitalism, it would seem that AG Schneiderman has a case of buyer’s remorse and examines why this lawsuit is a lashing with a wet noodle:

Now that that A.G. Schneiderman’s learned that Bank of America and Wells Fargo have failed to service 339 New Yorkers according to the standards dictated by the Settlement, he’s served notice he intends to sue. Not for money; for “equitable relief.” Though I’ve not seen a filing, I imagine if he actually will seek an injunction to get Wells and BofA to start complying with (specific performance of) the four servicing standards Schneiderman is targeting in his press release: [..]

The Bottom Line

It’s really hard to see how this effort-even if A.G. Schneiderman triumphs-leads to the kind of systemic change that was possible when all of the liability for the banks’ bad acts was still on the table. You know, pre-settlement, when A.G. Schneiderman and a few other Democratic A.G.s looked like they were going to stand up for America and insist on a meaningful deal.

Consider, the most that can come of this is two of the five banks complying completely with four of the 304 Servicing Standards.

AG Schneiderman joined MSNBC”S All In host Chris Hayes for an exclusive interview about why, after a multibillion dollar settlement, banks are still not living up to rules about mortgages and refinancing.

Feb 14 2013

SOTU: One Year Ago (Up Date)

Cross posted from The Stars Hollow Gazette

Last night President Barack Obama gave the annual State of the Union address before the nation and a joint session of Congress. He made a lofty speech outlining his plan for the nation over the next year, most of which are highly unlikely to come to fruition due to the intransigence of the Republican held House. Will any of this be remembered in a month? Or, for that matter, next year? Does anyone remember the promises and goals from last year’s SOTU? I doubt anyone remembers this:

EXCLUSIVE: Obama To Announce Mortgage Crisis Unit Chaired By New York Attorney General Schneiderman

by Sam Stein, The Huffington Post

WASHINGTON — During his State of the Union address tonight, President Obama will announce the creation of a special unit to investigate misconduct and illegalities that contributed to both the financial collapse and the mortgage crisis.

The office, part of a new Unit on Mortgage Origination and Securitization Abuses, will be chaired by Eric Schneiderman, the New York attorney general, according to a White House official.

Schneiderman is an increasingly beloved figure among progressives for his criticism of a proposed settlement between the 50 state attorneys general and the five largest banks. His presence atop this new special unit could give it immediate legitimacy among those who have criticized the president for being too hesitant in going after the banks and resolving the mortgage crisis. He will be in attendance at Tuesday night’s State of the Union address.

Ahh! Now, you remember that. Whatever happened to the Residential Mortgage-Backed Securities Working Group? Apparently not much.

Obama’s Mortgage Crisis Working Group Falls Short Of Billing

by Sam stein and Ryan Grim, The Huffington Post

A year later, progressives said they consider the panel a disappointment and, possibly, a diversion to placate Schneiderman and homeowner advocates. The Justice Department said it doesn’t know what the fuss is about.

“You described it as a unit that was announced to great fanfare,” said Tony West, the number three man in the Justice Department, in an interview. “A lot of people have the misimpression that this is some type of prosecutorial department that was set up. What the working group is is exactly that. It is part of the financial fraud enforcement task force. It doesn’t stand alone.” [..]

Schneiderman’s working group, critics said, has not lived up to that billing. [..]

According to those involved in putting together cases, officials at the SEC were naturally disposed to striking quick settlements rather than carrying out long-term investigations. The Justice Department, meanwhile, was worried about shaking a recovering housing market and fragile banks.

(Mike) Lux, in particular, pointed an accusatory finger at working group co-chairman Lanny Breuer, the assistant attorney general for the Justice Department’s Criminal Division, who has said he will leave his post next month. [..]

Whether driven by Breuer’s presence or not, the working group suffered from what the high-level source called “leaked leverage.” With different actors wanting slightly different outcomes, it closed cases that may have potentially been made bigger. Among those cited include one last month, when the Office of the Comptroller of the Currency and the Federal Reserve reached a $8.5 settlement with 10 U.S. banks on charges of foreclosure abuses.

Stein and Grim state that ‘progressives interviewed for this story who know and like Schneiderman offered the same conclusion: He got played.” Former blogger for FDL, David Dayen disagrees:

This is a joke. Schneiderman wasn’t “played” and anyone who says that is covering for him. huffingtonpost.com/2013/02/12/oba…

— David Dayen (@ddayen) February 12, 2013

I agree with David, Mr. Schneiderman’s settlement with banks here in New York have been disappointing, to say the least. He is not some naive neophyte. He knew precisely what he was signing up for when he was offered the position with this group.

Up Date: 18:12 EST 2.13.13: From David Dayen at Salon:

The secret truth: There never was a “task force” dedicated to ferreting out mortgage fraud

This is the key point. There are no offices, no phones and no staff dedicated to the non-task force. Two of the five co-chairs have left government. What “investigators” there are from the task force are nothing more than liaisons to the independent agencies doing their own independent investigations. In the rare event that these agencies file an actual lawsuit or enforcement action, the un-task force merely puts out a statement taking credit for it. Take a look at this in action at the website for the Financial Fraud Enforcement Task Force, the federal umbrella group “investigating” financial fraud. It’s little more than a press release factory, and no indictment, conviction or settlement is too small. The site takes credit for cracking down on Ponzi schemes, insider trading, tax evasion, racketeering, violations of the Americans With Disabilities Act (!) and a host of other crimes that have precisely nothing to do with the financial crisis. To call this a publicity stunt is an insult to publicity stunts. [..]

Maybe these groups who claim to be interested in accountability should have recognized the value of what pressured the White House to set up the diversionary tactic of a task force in the first place: public shaming. Last month’s Frontline documentary “The Untouchables” has had arguably more of an impact on reviving moribund financial fraud cases than anything else. Within a couple of weeks of its premiere, the head of the criminal enforcement division, Lanny Breuer, announced he would step down. Then, DoJ suddenly decided to sue credit rating agency Standard and Poor’s over its conflict of interest in rating clearly fraudulent securities as safe assets, a case it had been investigating for two years. You can view this as an accident of timing; it seems more like a direct response. Shaming has done far more than a pretend task force, though that’s admittedly a low bar. You would think outside pressure groups would have recognized the virtue of outside pressure instead of trying to play an inside game.

h/t priceman

Oct 04 2012

Don’t Expect Perp Walks

Cross Posted from The Stars Hollow Gazette

There will be no perp walks, or got that matter even arrests, in the civil suit against JP Morgan Chase for flawed mortgage-backed securities issued by Bear Stearns that was filed late Sunday night by Eric Schneiderman, New York State’s Attorney General. It’s the first lawsuit filed by Residential Mortgage-Backed Securities Working Group that was formed in January following President Barack Obama’s State of the Union address.

The complaint contends that Bear Stearns and its lending unit, EMC Mortgage, defrauded investors who purchased mortgage securities packaged by the companies from 2005 through 2007.

The firms made material misrepresentations about the quality of the loans in the securities, the lawsuit said, and ignored evidence of broad defects among the loans that they pooled and sold to investors.

Moreover, when Bear Stearns identified problematic loans that it had agreed to purchase from a lender, it was required to make the originator buy them back. But Bear Stearns demanded cash payments from the lenders and kept the money, rather than passing it on to investors, the suit contends.

Unlike many of the other mortgage crisis cases brought by regulators such as the Securities and Exchange Commission, the task force’s action does not focus on a particular deal that harmed investors or an individual who was central to a specific transaction. Rather, the suit contends that the improper practices were institutionwide and affected numerous deals during the period.

The lawsuit, however, is not Federal and relies on NY state banking law:

The decision to pursue civil charges under New York’s Martin Act means that the state’s attorney general will not have to prove fraudulent intent, only that the firm was negligent in making any false or misleading disclosures. While easier to prove, that also indicates that the evidence to prove fraud was not strong enough to bring more serious charges.

Like so many cases related to the financial crisis, no individuals are named in the complaint. Nor does it appear that any criminal charges will emerge this long after Bear Stearns was pushed into the arms of JPMorgan by the federal government in a transaction routinely described as a fire sale.

Yves Smith is skeptical about any large fines:

It looks like Eric Schneiderman is living up to his track record as an “all hat, no cattle” prosecutor. Readers may recall that he filed a lawsuit against the mortgage registry MERS just on the heels of Obama’s announcement that he was forming a mortgage fraud task force. Schneiderman’s joining forces with the Administration killed the attorney general opposition to the settlement, allowing the Administration to put that heinous deal over the finish line. The MERS filing was a useful balm for Schneiderman’s reputation, since it preserved his “tough guy” image, at least for the moment, and allowed his backers to contend that he had outplayed the Administration. [..]

Schneiderman has churned out another lawsuit that the Obama boosters and those unfamiliar with this beat might mistakenly see as impressive. It’s a civil, not criminal suit against JP Morgan he conduct of Bear Stearns in originating and misrepresenting $87 billion of mortgage backed securities (the link takes you to the court filing). And also notice no individuals are being sued. Being a banker apparently means never having to be responsible for your actions.

This suit appears just in time for an “October Surprise” and right before the first debate that will focus on domestic policies. This looks like more campaign PR.

Aug 22 2012

“Foaming the Runway for the Banks”

Cross posted from The Stars Hollow Gazette

Disregard all cheery news you hear from the MSM that the housing crisis is over and housing prices are stable and on the rise. It’s not over. We are still bailing out the banks over the troubled homeowner.

“The evidence is overwhelming: home prices are anything but stable.”

Michael Olenick: Still Looking for a Housing Bottom

Two trends are apparent. One is that banks are delaying foreclosures, or not foreclosing at all despite long-term delinquencies. The other is that private equity firms – flush with cash thanks to Tim Geithner’s religious devotion to trickle-down economics and the resulting cascade of corporate welfare – have been bidding up and holding foreclosed houses off the market. These two factors have artificially limited supply and, combined with cheap mortgages rates, driven up prices. While we can debate whether these strategies represent the best public policy, these policies are obviously not long-term sustainable. [..]

Holding back inventory means that the houses that are put on offer sell faster and at higher prices. That creates an incentive to delay foreclosures or not foreclose at all even when a home is delinquent. Though this seems obvious, the mainstream housing finance community – aided by a freelance “housing analyst,” – uses the faster figures to somehow prove banks are not holding houses. [..]

Besides lower foreclosure activity, the government is going all out to give away houses to private equity firms. Recently Fannie Mae sold 275 properties across metro Phoenix in one sale to a mystery buyer, according to a report by Catherine Reagor of the Arizon Republic. [..]

Anybody who has been a landlord seems to quickly tire of it so, assuming there isn’t a pending planned mass immigration to Phoenix, these investors will eventually want to cash out by selling these houses. Further, they will want to minimize maintenance expenses while they are renting out these houses, so the eventual sale of these houses will increase supply and prolong the housing crisis. Geithner’s policy of shaking down Main Street to help Wall Street continues to hurt your street. [..]

Taking account of the delayed foreclosures and the beginning of mass purchases of houses would mean there should be a surge in home prices, but we’re still seeing little movement in many areas. This is especially puzzling given how inexpensive mortgage are. [..]

Of course, this assumes that people can get mortgages for these houses, though many can’t. Young people especially are hopelessly in debt thanks to out-of-control tuition hikes predictably caused by equally out-of-control student loan policies. [..]

Thanks to low lower foreclosures, real-estate speculators buying in bulk, and low interest rates there is enough direct and anecdotal evidence to suggest that we may be seeing a real-estate recovery on paper. Further, these policies are clearly calibrated to bring about a bubble, despite that bubbles are difficult to control and are not, by definition, sustainable: they always eventually pop. Let’s at least hope that when this bubble bursts the new Wall Street bulk buyers are treated with the same ruthless “free market” vigor that the prior owners of these houses were treated with after the last bubble burst. However, I doubt the mystery Asian money buyer, that Fannie sold Phoenix to, will ever be subject to something like the rocket docket.

Washington’s Blog goes down the list of evidence that “the government’s “Homeowner Relief” Programs are disguised bank bailouts … not even AIMED at helping homeowners. It’s a fascinating piece with all the links to this sham.

Former special inspector general overseeing TARP Neil Barofsky (@neilbarofsky) joined Up w/ Chris Hayes to talk about his book “Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street.” Along with panel guests Heather McGhee (@hmcghee), vice president of policy and research at the progressive think tank Demos; Josh Barro (@jbarro), who writes “The Ticker” for Bloomberg View; Michelle Goldberg (@michelleinbklyn), senior contributing writer for Newsweek/Daily Beast; and Up host Chris Hayes (@chrislhayes), Barofsky shares his thoughts on the failure of TARP and the housing crisis.

Apr 20 2012

Mortgage Fraud: Task Force Still An Empty Promise

Cross posted from The Stars Hollow Gazette

85 days and counting since President Obama announced in his State of the Union speech the formation of the Residential Mortgage Backed Securities Working Group (RMBS) co-chaired by NY State Attorney General Eric Schneiderman and it is still a toothless entity that has so office space, phones and has yet to be staffed. The New york Daily News noticed, suggesting that Schneiderman should quit this fraud:

[..]calls to the Justice Department’s switchboard requesting to be connected with the working group produced the answer, “I really don’t know where to send you.” After being transferred to the attorney general’s office and asking for a phone number for the working group, the answer was, “I’m not aware of one.”

The promises of the President have led to little or no concrete action.

In fact, the new Residential Mortgage Backed Securities Working Group was the sixth such entity formed since the start of the financial crisis in 2009. The grand total of staff working for all of the previous five groups was one, according to a surprised Schneiderman. In Washington, where staffs grow like cherry blossoms, this is a remarkable occurrence.

We are led to conclude that Donovan was right. The settlement and working group – taken together – were a coup: a public relations coup for the White House and the banks. The media hailed the resolution for a few days and then turned their attention to other topics and controversies.

But for 12 million American homeowners, collectively $700 billion under water, this was just another in a long series of sham transactions.

Schneiderman, who has acted boldly and honorably, should distance himself from this cynical arrangement. He should resign and go back to working effectively with fellow attorneys general in Delaware, Massachusetts and Nevada.

They are much more likely to create the kind of culture of accountability in the financial community that will protect U.S. families from the next real estate scam.

According to a Reuter’s report, the office space has been located:

The task force includes the Justice Department, the SEC, the FBI and the Department of Housing and Urban Development, among others. It is charged with investigating the pooling and sale of home loans that contributed to the financial crisis.

While the group faced some skepticism, considering the crisis began nearly five years ago, there are signs it is serious about bringing cases.

The co-chairs meet formally every week and talk almost every day to coordinate on “a range of investigations,” a Justice Department official said, on condition of anonymity.

About 50 staff members are working on the effort, and the task force has identified separate office space in Washington and will move some personnel there, the official said.

The Justice Department last month posted a one-year position of full-time coordinator for the working group who could help manage discovery and coordinate investigations, according to the job posting.

Yves Smith at naked capitalism agrees that Schneiderman has been had by the Obama administration:

It was pretty obvious Schneiderman had been had. Obama tellingly did not mention his name in the SOTU. Schneiderman was only a co-chairman of the effort and would still stay on in his day job as state AG, begging the question of how much time he would be able to spend on the task force. His co-chairman is Lanny Breuer from the missing-in-action Department of Justice. And most important, no one on the committee was head of an agency, again demonstrating that this wasn’t a top Administration priority.

However, she disagrees with the Daily News assessment of Schniederman acting “boldly and honorably” and that he can go back to working with the other attorneys general:

Schneiderman’s actions were neither bold nor honorable. Not surprisingly, his effort at a star turn in the national media has not led to favorable poll results for him in New York. And the Daily News offers a fantasy as an alternative. There is no “going back.” The attorneys general gave up their best legal theories, and with it, their ability to protect the integrity of title, for grossly inadequate compensation and a photo opportunity.

It would be better if we were proven wrong, but Schneiderman entered into an obvious Faustian pact. He’s not getting his soul or his reputation back.

Meanwhile as reported by Think Progress,

A recent report showed that mortgage foreclosure scams have spiked 60 percent in 2012, while the nation’s biggest banks continue to sit upon a slew of fraudulent mortgage documents. A recent investigation of foreclosures in San Francisco found that nearly all of them had legal problems or suspicious documents, prompting the city council to suggest a foreclosure moratorium.

Apr 19 2012

Another “Hero” Fails

Cross posted from The Stars Hollow Gazette

I supported Eric Schneiderman in his run for NY state AG in hopes he would carry on the legacy of Eliot Spitzer as the “sheriff of Wall St.” I was wrong, he sold out for whatever reasons, as did NY’s current governor Andrew Cuomo. In the article by Matt Stoller at naked capitalism, (a good analysis of NY AG Schneiderman), the comments about Clinton, Obama, Democrats and the alleged 2 party system would get them all banned from certain pro Obama/”Democratic” web sites.

Just a sample:

“Yeah, when ya get promoted from shaved ape and get sworn in as a human being, one of the things you do have to sign up for is the Torture Convention. This is true of everyone. Commit torture, condone torture, acquiesce to torture, and you are, in the technical legal terminology, hostis humani generis, enemy of all mankind. So in what parallel universe could notional “good Democrats” exist in a party whose leader, Barack Obama, openly violated Articles 12 and 16 of The Convention Against Torture?”

“It is quite amazing how the left-most Democrats on economic issues, like Schneiderman and Elizabeth Warren, casually support massive war crimes.

Look what Schneiderman and Warren support: massive secret wars in over 100 countries, drones that kill far more innocent than targets, cluster bombs, assassination lists, obscene rules of engagement that allow for the targeting of civilians, proxy wars, massive media manipulation and propaganda, and legalized torture.

The Democrats have surpassed even the Nazi party in their extremism!

Right now, in fact, the Democrats are aiding and abetting a criminal act of aggression against Syria (even down to the level of NGOs like MoveOn and Avaaz possibly supporting terrorism).”

“But…but…if Obama isn’t re-elected, then Mitt Romney will, uh… he’ll, uh… well, I guess he’ll do exactly the same things. But he’ll be a Republican, you see!”

The comments about Bill Clinton are equally scathing;

And what exactly did Clinton accomplish ? Repeal Glass-Steagall ? Undo the New Deal ? Start a private debt bubble that led to our current depression ?

But getting back to Schneiderman. He sold out, crossed over to the dark side. He went from being a hero to being a sellout. He’s got nuthin.

Don’t forget Clinton negotiated a deal to cut Social Security, which was only stopped by the Lewinsky scandal.

You forgot….in addition to eliminating Glass Steagall, Clinton also passed that wonderful “job creator” NAFTA…..remember?

But wait! That’s not all! From Slick Willie-for the same low, low bribe – you also got the Telecom Act, aka Rupert Murdoch Monopoly Act. And for a limited time, while supplies last, lobbyists will pay all your shipping and handling charges.

According to Common Cause: “…the Telecom Act failed to serve the public and did not deliver on its promise of more competition, more diversity, lower prices, more jobs and a booming economy.

“Instead, the public got more media concentration, less diversity, and higher prices.

“Over 10 years … cable rates have surged by about 50 percent, and local phone rates went up more than 20 percent.”

As WEB Dubois said in 1956 when he announced, I will not vote “:

In 1956, I shall not go to the polls. I have not registered. I believe that democracy has so far disappeared in the United States that no “two evils” exist. There is but one evil party with two names, and it will be elected despite all I can do or say. There is no third party.

I am nearly to that point. If there is no other choice but evil. I will not vote.

Mar 20 2012

Foreclosure Fraud: More Reasons to Hate It

Cross posted from The Stars Hollow Gazette

The more the experts and analysts look into the Foreclosure Agreement the more reasons are found to hate it and why, to Yves Smith‘s descriptive word, it “sucks”:

Not only are the banks getting away with fraud they are still going to be allowed to systemically overcharge homeowners and wrongly take their homes.

Remember that the Administration also trumpeted that enforcement would be tough, even as Abigail Field has shown that idea to be a joke. For instance, the servicing standards allow for the astonishing concept of an acceptable error rate. Banks aren’t permitted to make errors with your checking account and ding you an accidental $10,000 and get away with it. But with people’s most important asset, their homes, servicers are allowed a certain level of reportable errors, and many of them can be serious as far as borrowers are concerned.[..]

She also points out that wrongful foreclosures at a 1% rate are acceptable. Procedures around real estate are deliberate because any error of this magnitude has devastating consequences. But this new provision means that 1%, or over 33,000 erroneous foreclosures since 2008 would be perfectly OK as far as the authorities are concerned.

Field also points out in a separate post that this deal is in no way done. Key points remain to be resolved, in particular, how the Monitor will supervise the pact. That’s a huge item, and leaving it unresolved shifts the power to the banks (if you don’t believe me, I refer you to what is happening to Dodd Frank).

Field also wonders “how did all our meaningful law enforcers do this deal?:

I hate the term Too Big To Fail because it’s a loaded premise presented as fact. But looking at the weasel parentheticals, maybe we should start asking if the banks as too big to be competent. I mean, why do the banks need a ‘hey, we tried but didn’t have enough time to stop the sale’ exemption? If the B.O.Bs (bailed out bankers) want their lawyer or trustee to call off a foreclosure sale, all they need is two things: a) to contact their agent and b) have a competent agent.

What does “took appropriate steps to stop the sale” mean, anyway? Does it mean that someone at the bank left a message or two with foreclosure counsel? If the B.O.B.s made a real effort to stop the sale but their agents did it anyway, why isn’t that the B.O.B’s fault for having incompetent agents? Doesn’t giving the B.O.B. a pass remove any incentive to have competent (and thus more expensive) agents?

Wrongfully selling someone’s home should be a strict liability issue. Strict liability is, well, strict: no one cares what you were trying to do, what your intentions were, what you did or didn’t do. Did the harm happen? Then you’re responsible.

Before you give me any, hey, let’s be reasonable here, a business needs to operate and we’re so big some mistakes will happen, remember what we are talking about: homes; property rights; land records; fundamental fairness. How can the B.O.Bs be held to any standard other than strict liability when it comes to wrongfully selling a home?

Neil Barofsky, the former Special US Treasury Department Inspector General for the Troubled Asset Relief Program (TARP) and Matthew Stoller, a fellow at the Roosevelt Institute give a good overview of why this settlement really “sucks”

There is no accountability, no punishment for what has to be the largest fraud ever perpetrated in this country.

Mar 17 2012

Foreclosure Fraud: More Foreclosures

Cross posted from The Stars Hollow Gazette

Who could have possibly thought that by giving the banks a pass on foreclosure fraud with the 49 state agreement that there would be an increase in foreclosures? That prediction came from Mark Vitner, an economist with Wells Fargo:

“The immediate results are not going to be all that pleasant,” said Mark Vitner, an economist with Wells Fargo. His bank is one of the biggest lenders in Florida as well as a participant in the settlement. “The amount of foreclosures will actually increase and there will be some additional downward pressure on home prices.”

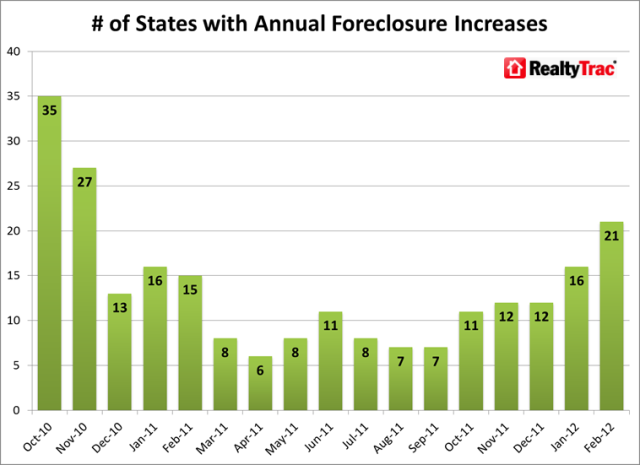

And foreclosures are on the rise in half of the major metro areas:

February foreclosure activity in the 26 states with a judicial foreclosure process increased 2 percent from January and was up 24 percent from February 2011, while activity in the 24 states with a non-judicial foreclosure process decreased 5 percent from January and was down 23 percent from February 2011.

Half of largest metro areas post annual increases in foreclosure activity

Ten of the nation’s 20 largest metro areas by population documented year-over-year increases in foreclosure activity in February, led by the Florida cities of Tampa (64 percent increase) and Miami (53 percent increase).The 10 metro areas with increases were all on the East Coast or in the Midwest, while most of the metro areas with year-over-year decreases in foreclosure activity were in the West, led by Seattle (59 percent decrease) and Phoenix (43 percent decrease).

The metro areas with the highest foreclosure rates among the 20 largest were Riverside-San Bernardino in California (one in 166 housing units), Atlanta (one in 244), Phoenix (one in 259), Miami (one in 264) and Chicago (one in 302).

Meanwhile robosigning has still not stopped. Matt Stoller at naked capitalism found according to the HUD Inspector General Report Well Fargo is still using it:

At the time of our review, affidavits continued to be processed by these same signers, who may not have been qualified, and these signers may not have adequately verified certain figures because they accessed a computer screen of data showing a compilation of figures instead of verifying the data against the information through review of the books and records kept in the regular course of business by the institution.

Stollers reaction deserves repeating:

I’m sorry, but WHAT THE $&*@!?!? I’m so glad Eric Holder has cut a deal with Al Capone while Capone is still on a shooting spree. And note, this isn’t just robosigning, this is potentially overcharging homeowners with junk fees and just generally not verifying accurate data on who owes what to whom. There really is no lesson here except “crime pays”.

And they are still stealing homes.